A Historical Perspective on ETFs

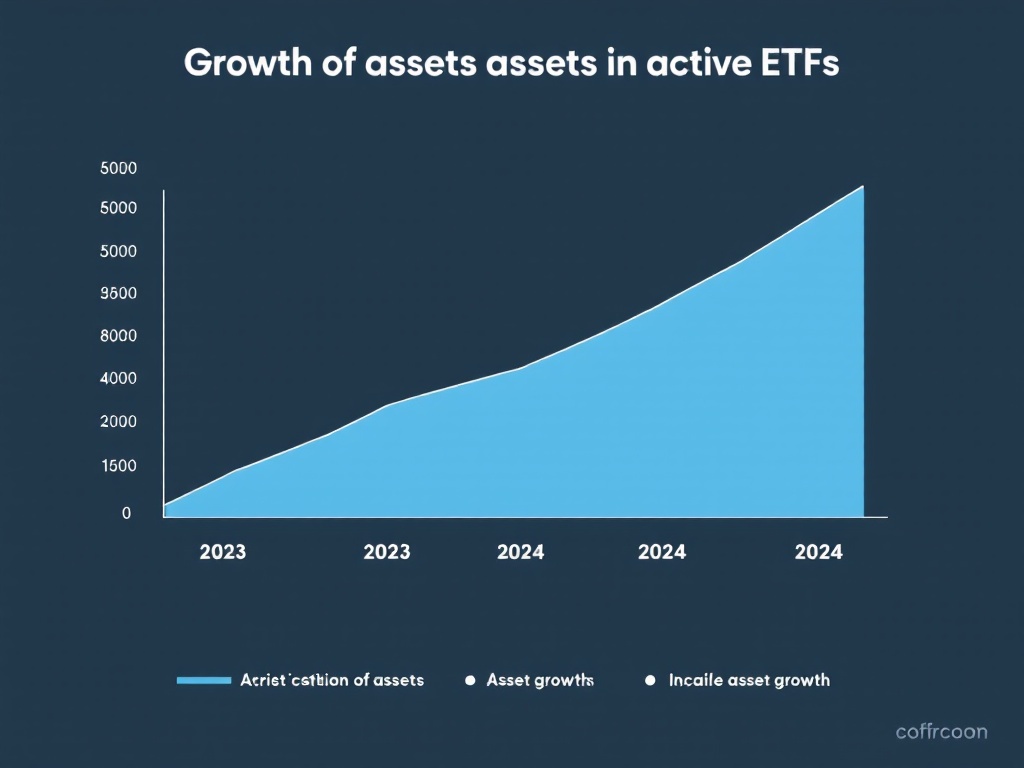

Exchange-Traded Funds (ETFs) have revolutionized investment portfolios since the early 1990s. Initially focused on passive strategies tracking market indices, ETFs became popular for their cost-effectiveness, transparency, and tax efficiency. Over time, their scope has expanded to include diverse asset classes, catering to both retail and institutional investors.